Volumetrica Trading offers professional trading and analytical platforms designed for order flow analysis. VolSys offers the most powerful indicators in order to understand the market movements through the volume analysis, while VolBook offers an innovative way to view the depth of the market.

Order Flow Analysis

Volumetrica Trading Platform Fees

| Version | Monthly | Quarterly | Biannually | Annually |

| VolBook | €65 | €180 | €330 | €600 |

| VolSys | €95 | €255 | €450 | €780 |

Traders who want to use Volumetrica Trading must signup directly on the Volumetrica Trading website. We do not facilitate payment services to use their trading platform.

| Data Feed | Monthly |

| CQG | $10 |

| GAIN | $10 |

| Rithmic | $25 |

These are pass through fees from the data feed providers to connect their API to Volumetrica Trading. These fees are debited from your trading account and made payable to the data feed providers.

Intraday Margins

Commissions

Deposit Minimum

Volumetrica Trading Platform Demo

Demo trading is a powerful tool to help develop trading skills,

test different strategies, and fine-tune trading systems.

- Learn how to use the platform

- Practice trading with no risk

- Access the global markets

- Real-time market data

Sign Up Today

VolSys Platform Features

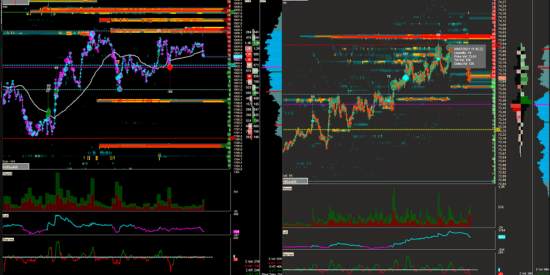

VolSys is a professional trading platform which its main goal is the analysis of the volume profiles, time and sales, order flow, and footprint.

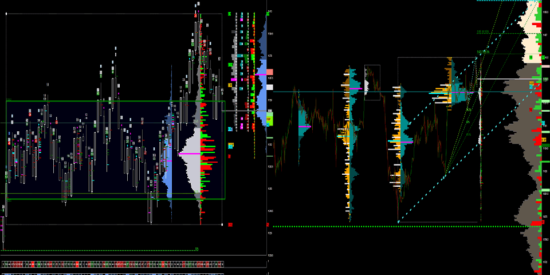

Volume Profile

Volume profile is one of the most powerful volume indicators because it highlights the most interested zone of price and how they were executed thanks to the delta profile.

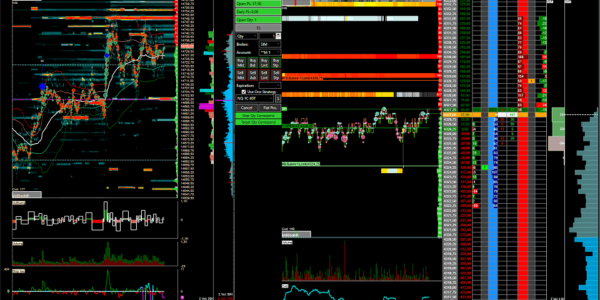

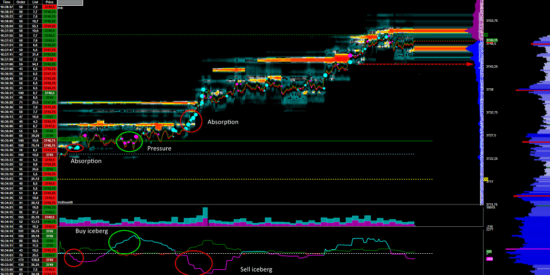

Order Flow Analyzer

Order flow analyzer combines price, volume, and order flow in a single bar. It helps traders to identify potential support and resistance zone, buyer/seller acceleration, absorption, exhaustion, trapped, and other market actions.

Charts

A whole range of innovative indicators allowing transformation of order flow into a comprehensible form, easy and clear for visual perception.

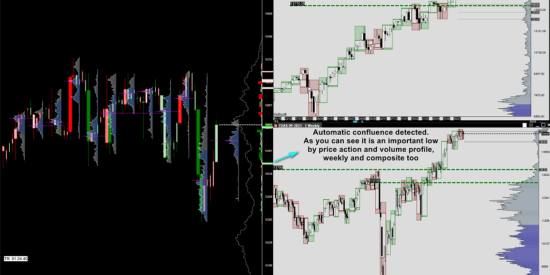

Confluence Identifier

This indicator combines daily, weekly, monthly, composite profile, zig-zag swing, and Fibonacci retracements providing macro and micro levels of supply and demand based both on price and volume.

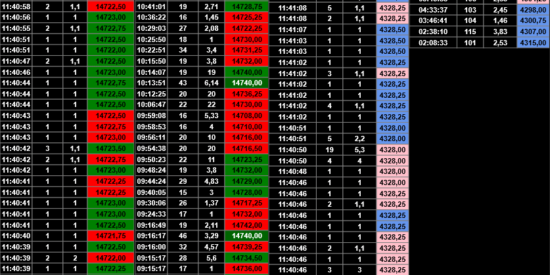

Advanced Time and Sales

Easily see the actual market orders to their full extent and it allows traders to filter the size of the orders to sense what the bigger/smaller traders are doing.

Trading

Trade directly from the chat with OCO strategy, breaking the position in small pieces and close them at different prices, or fast order submission with shortcuts on the keyboard.

VolBook Platform Features

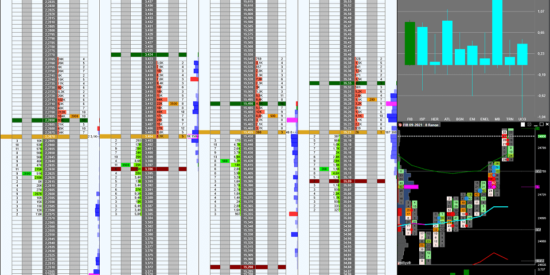

VolBook is a professional volume trading platform which offers an innovative way for the display and the analysis of the market depth without neglecting the study of the level 1.

Book Liquidity Chart

The heart of the platform is the market depth analysis through a heatmap where each price level changes color based on the amount of limit orders placed at that level, helping traders to identify support and resistance book zone and where the market is going because the price moves up and down searching the liquidity in order to execute orders.

Volume Bubbles

Trades are displayed as bubbles which size depends on the amount of volume executed. This allows traders to identify the book action like spoofing, layering or when the limit orders are really executed.

Chart DOM

Traders can enter orders in a very fast and efficient way along with analyzing pulled, stacked, and executed orders. Traders can place limit orders and market orders with only one click.

Iceberg and Stops

With market by order (MBO), VolBook can recognize executed iceberg and stop orders in the market.

With multiple trading platforms and data feed options, traders can access the world of futures trading with competitive intraday margins and low commissions.