TradingView is a strategy platform for investors, traders, and chartists. It provides real-time data and browser-based charts for research from anywhere, since there are no installations or setups. Traders can use TradingView on any modern browser and start charting, learning, and sharing trading ideas. The platform provides data charts for a wide range of futures products and allows users to chat about trends and ideas.

Cloud Based Platform

Tiger.Trade Platform Fees

| Monthly | Quarterly | Annually | Lifetime |

| $55 | $124 | $399 | $1,500 |

Traders who want to use Tiger.Trade must signup directly on the Tiger.Trade website. We do not facilitate payment services to use their trading platform.

| Data Feed | Monthly |

| GAIN | $10 |

| Rithmic | $25 |

These are pass through fees from the data feed providers to connect their API to Tiger.Trade. These fees are debited from your trading account and made payable to the data feed providers.

Intraday Margins

Commissions

Deposit Minimum

Tiger.Trade Platform Demo

Demo trading is a powerful tool to help develop trading skills,

test different strategies, and fine-tune trading systems.

- Learn how to use the platform

- Practice trading with no risk

- Access the global markets

- Real-time market data

Sign Up Today

Tiger.Trade Platform Features

The social network for your finance life. Get creative with the futures markets by being part of the largest social network on the web for traders and investors.

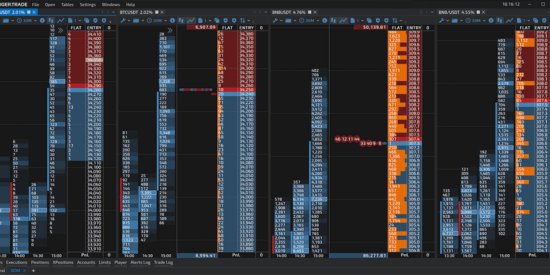

Charts

Tiger.Trade offers several types of charts, including a classic candlestick chart and a footprint graph. The chart sections extensive list of indicators and graphical objects allows for thorough technical analysis.

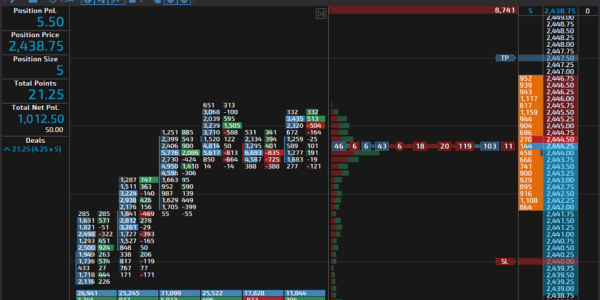

Depth of Market

Clearly and intuitively shows the dynamics of price changes so traders can accurately assess the priority direction of the market.

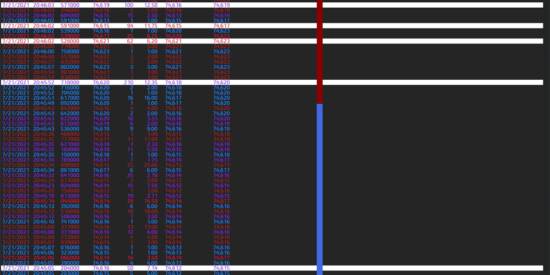

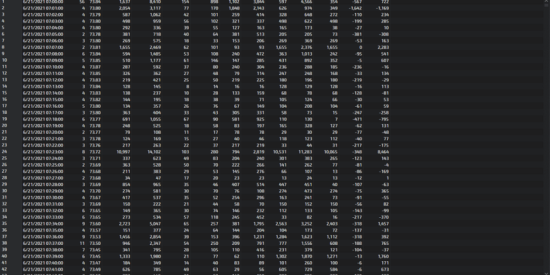

Trade Feed

The trade feed displays market orders as they are completed. A table in this window presents information about trade time, price, volume, and buy/sell direction.

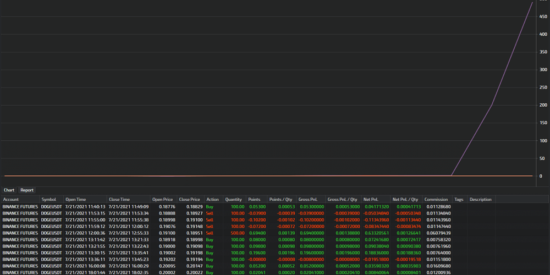

Statistics

Comprehensive information is provided for each trade, including opening and closing times, buy/sell direction, volume, profits or losses, and commission. The data is refreshed in real-time and allows traders to evaluate their trades.

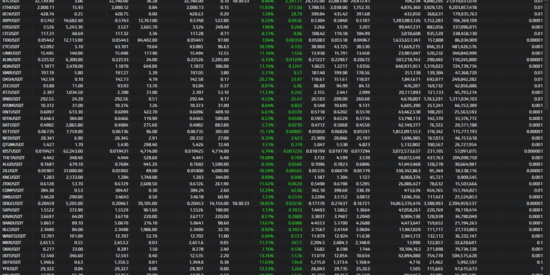

Quotes

Track the ever-changing parameters of trading instruments, the most important of which are percent of price change from opening price, price after trade, and open interest.

Analytics

The terminal contains two modules for analytics: all prices and volume search. The all prices table displays information about the traded volume at each price during a certain time internal, which plays an important role in determining the key levels for upcoming trading sessions. The volume search module helps traders take a closer look at the state of the market, making it possible to search for large volumes and identify their locations on the chart.

With multiple trading platforms and data feed options, traders can access the world of futures trading with competitive intraday margins and low commissions.