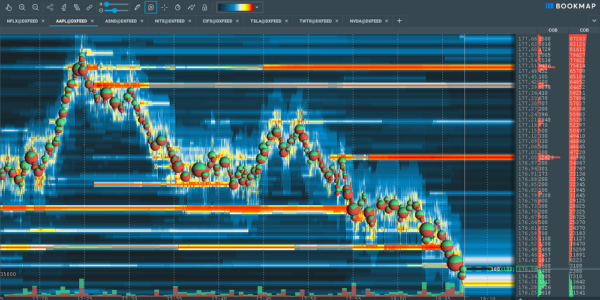

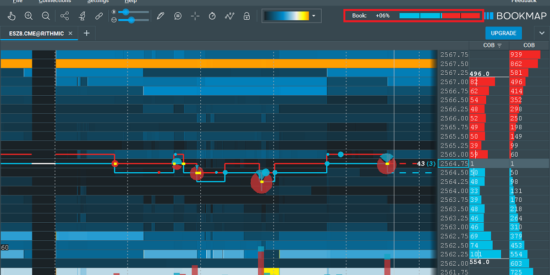

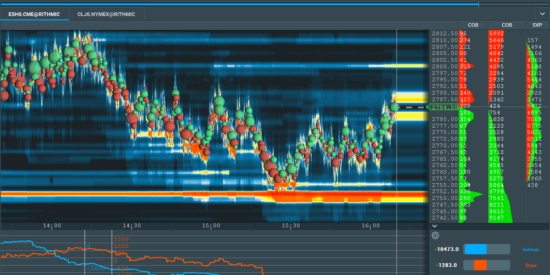

BookMap is a cutting-edge trading platform that lets traders visualize market liquidity and gain incredible insight into the order book. Trade with confidence and watch the market evolve in real-time at 40 frames per second. Identify market trends, discover hidden price patterns, and understand order flow like never before.

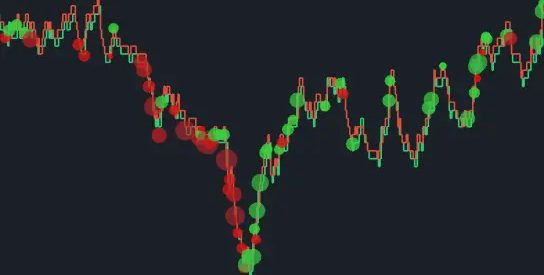

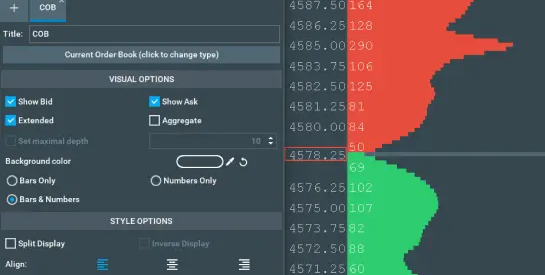

Gain real-time order flow insight using the fully configurable limit order book (COB) and depth of market (DOM). Identify incoming market volume and watch absorption and exhaustion unfold to spot reversals before they happen.