ATAS trading platform is for advanced technical analysis, market profile and order flow analysis. Traders can analyze historical data, carry out cluster and portfolio analysis, adjust alternative frames for charts, and set unique formulas for synthetic spreads. ATAS processes the order flow data and visualizes it in an intuitive form.

Order Flow Analysis

ATAS Platform Fees

| Version | Monthly | Annually |

| Pro | $14.95 | $155.40 |

| Pro+ | $29.95 | $299.40 |

| Premium | $59.95 | $599.40 |

Traders who want to use the TradingView trading platform must signup directly on the TradingView website. We do not facilitate payment services to use their trading platform.

| Data Feed | Monthly |

| CQG | $10 |

These are pass through fees from the data feed providers to connect their API to TradingView. These fees are debited from your trading account and made payable to the data feed providers.

Intraday Margins

Commissions

Deposit Minimum

ATAS Platform Demo

Demo trading is a powerful tool to help develop trading skills,

test different strategies, and fine-tune trading systems.

- Learn how to use the platform

- Practice trading with no risk

- Access the global markets

- Real-time market data

Sign Up Today

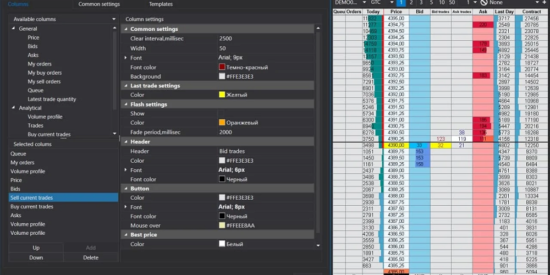

ATAS Platform Features

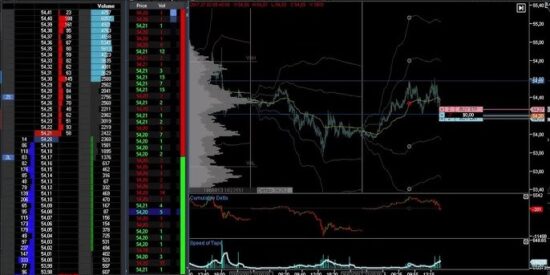

ATAS specializes in analyzing order flow, volumes, and liquidity in the DOM. This information gives an understanding of balance/imbalance between buyers and sellers which is the root causes of price movements in the market.

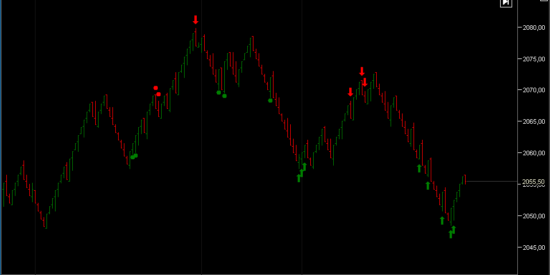

Charts and Clusters

See the market through the eyes of a professional. ATAS offers unlimited possibilities for building and customizing charts.

Indicators

Use 200+ technical analysis indicators in combination with the most advanced volume analysis tools. All indicators have flexible settings to set alerts on them.

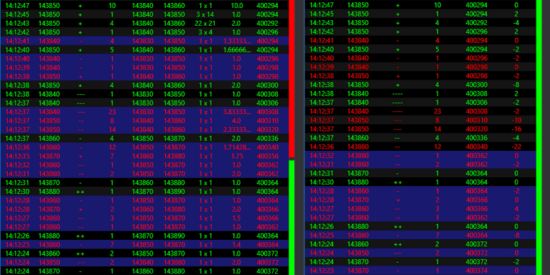

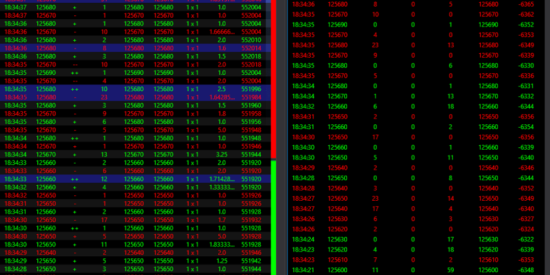

Smart Tape

Smart Tape combines individual prints back together so traders can easily see the actual market orders in their full extent. There are also filters available in the Smart Tape to easily sense what the bigger/smaller traders are doing at the moment.

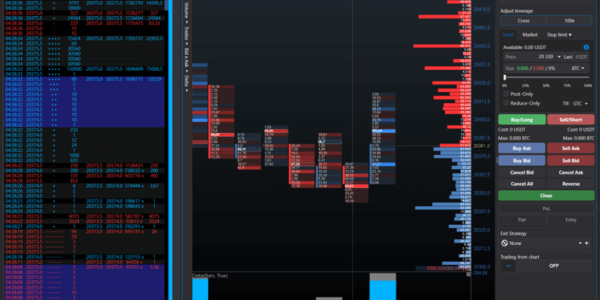

Smart DOM

Smart DOM (Order Book) is not only a powerful scalping tool, but also an instrument for analyzing limit orders. This innovative tool designed to spot and analyze activity of high frequency algorithms.

Big/Ask Tape

This module allows traders to see the volume of trades, which were settled based on bid and ask in the process of the price movement. Traders behavior can be analyzed at any given time while approaching a certain price level.

Market Replay

Market Replay is an emulator that recreates past trading activity in real-time. Learn to trade, test strategies or robots without risking real capital.

With multiple trading platforms and data feed options, traders can access the world of futures trading with competitive intraday margins and low commissions.